Sales executives are often measured on revenue attainment regardless of the financial health of the deals sold. It is generally the responsibility of management to spot unhealthy deals and to ask the sales executive to either do better or to walk away from a deal. But how do you recognise what a healthy deal is, in as far as pricing is concerned?

As with most things, it’s really simple in theory. The customer will buy if the price offered is lower than or equal to the willingness-to-pay (WTP). Conversely, the company will execute the deal if it has a healthy contribution and the price is close to the customer’s WTP.

So, in an ideal world, managers would know the customer’s WTP for each deal and the contribution for each deal. Sales executives would only make healthy deals and would walk away from unhealthy deals. In reality, however, a lack of information and experience leads to flawed deals.

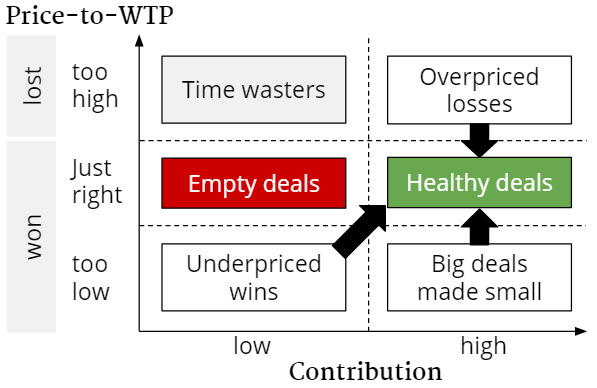

The matrix below describes 6 types of deals by their contribution level and their price compared to the customer’s WTP. Only 1 of the deal types in the matrix is a healthy deal, but 3 other types can be made into healthy deals, provided you can recognise them in time. Needless to say, this is where companies can create value with better pricing.

Let’s take a closer look. Firstly, there are deals with a low contribution. These are ‘Time wasters’, ‘Empty deals’, and ‘Underpriced wins’.

Time wasters are deals that were lost because the price offered was above the customer’s WTP and the deal would have had a low contribution if it would have been signed.

Action: Disqualify. If your organisation spends time on these deals you need to strengthen your opportunity qualification. Create a clear understanding of the minimum deal size that you require and disqualify opportunities that are small, have a weak business case, or fall outside of your target segments.

Empty deals are deals that are priced at or just below the customer’s WTP but that have a low to negligible contribution. These deals do not create value for the company but do consume company resources.

Action: Disqualify. Make sure your team understands the opportunity cost of hunting after empty deals. Look out for sales executives who claim that deals are ‘strategic’ or necessary to create a ‘reference’ or a ‘beachhead in a new market’. These reasons to ask for a discount are often overused.

Underpriced wins are deals that are priced below the customer’s WTP and could, therefore, be priced higher. These deals are won, but at a level where the contribution is low.

Mitigation: Maintain pricing discipline. These deals are often the result of a lack of pushback on requests for discounts. Work on a business case with the customer to agree on the value your product or service brings before proposals are made. In this way you can anchor prices closer to the value you offer the customer.

Secondly, there are deals with a high contribution. These are ‘Overpriced losses’, ‘Healthy deals’, and ‘Big deals made small’.

Overpriced losses are deals that were lost because the price offered exceeded the customer’s WTP. However, the price could have been lowered below the customer’s WTP with enough contribution left to create a healthy deal.

Mitigation: Reduce price. Keep detailed records of won and lost deals to gauge what a realistic price level and contribution is. The contribution in these deals will be much higher than average and customers will communicate some form of disbelief over the proposed price. Often customers will argue the price makes their business case unviable. If your business analysts can substantiate this, you run the risk of an unnecessary loss.

Healthy deals are priced at the customer’s WTP and yield an attractive contribution. (What a healthy contribution is, as a contribution margin or as an absolute number, depends on your cost structure and your industry.)

Big deals made small are deals that have a healthy contribution but are nevertheless priced below the customer’s WTP. These deals look healthy but could have been more profitable still.

Mitigation: Make a business case with the customer before you price and defend the value based on the business case. Don’t allow yourself to be intimidated by the deal size, even if it is much larger than your typical deal size.

If you’d like to learn more about creating healthy deals with better pricing, please contact us with your questions.